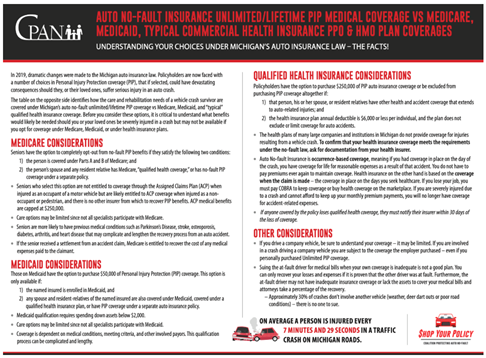

Give this important resource to your Medicare and Medicaid patients. If they decide to opt out of auto no-fault, that decision could have devastating ramifications!

Download this important patient resource here.

By: Tim Gaughan, MAC Assistant Director / CPAN Executive Committee Member

The MAC office often gets calls from member offices with patients who have been injured in an auto accident and have “opted out” of Personal Injury Protection (PIP) coverage and are now facing dire consequences for doing so.

For more than four decades, Michigan’s auto no-fault law ensured that individuals and their loved ones would have their care covered if they were seriously injured in a motor vehicle crash, no matter who was at fault. That all changed in 2019, when Michigan lawmakers amended the law. The major changes brought about by this new law have dramatically affected all consumers and their families. This is especially true for seniors and those on Medicare or Medicaid.

Under these amended laws, drivers are now required to make certain specific choices regarding their medical expense and liability insurance coverages. Make no mistake about it, these choices and their associated risks are significant, especially when driving is the most dangerous activity many people do on a regular basis. Below are how these choices can affect patients with the following coverages:

- Medicare

- Medicaid

- Qualified health insurance

Medicare

Seniors have the option to completely opt-out from no-fault PIP benefits, if they satisfy the following two conditions:

- They are covered under Parts A and B of Medicare, and

- The person’s spouse and any resident relative has Medicare, “qualified health coverage,” or has no-fault PIP coverage under a separate policy.

Seniors should take the following into consideration before opting out of PIP in favor of their Medicare coverage:

- Care options may be limited since not all specialists participate with Medicare.

- Seniors are more likely to have previous medical conditions such as Parkinson’s Disease, stroke, osteoporosis, diabetes, arthritis, and heart disease that may complicate and lengthen the recovery process from an auto accident.

- Seniors who select this option are not entitled to coverage through the Assigned Claims Plan (ACP) when injured as an occupant of a motor vehicle but are likely entitled to ACP coverage when injured as a nonoccupant or pedestrian, and there is no other insurer from which to recover PIP benefits. ACP medical benefits are capped at $250,000.

- If the senior received a settlement from an accident claim, Medicare is entitled to recover the cost of any medical expenses paid to the claimant.

Medicaid

Medicaid beneficiaries have the option to purchase $50,000 of PIP coverage, if:

- The named insured is enrolled in Medicaid, and

- Any spouse and resident-relatives of the named insured are also covered under Medicaid, covered under a qualified health insurance plan, or have PIP coverage under a separate auto insurance policy.

Those on Medicaid should take the following into consideration before opting out of PIP:

- Medicaid qualification requires spending down assets below $2,000.

- Care options may be limited since not all specialists participate with Medicaid.

- Coverage is dependent on medical conditions, meeting criteria, and other involved payors. This qualification process can be complicated and lengthy.

Qualified Health Insurance

Policyholders have the option to purchase $250,000 of PIP auto insurance coverage or be excluded from purchasing PIP coverage altogether, if:

- That person, his or her spouse, or resident relatives have other health and accident coverage that extends to auto-related injuries, and

- The health insurance plan annual deductible is $6,000 or less per individual, and the plan does not exclude or limit coverage for auto accidents.

Before opting out of PIP coverage, those with qualified health insurance should know:

- The health plans of many large companies and institutions in Michigan do not provide coverage for injuries resulting from a vehicle crash. To confirm that your health insurance coverage meets the requirements under the no-fault law, ask for documentation from your health insurer.

- Auto No-fault Insurance is occurrence-based coverage, meaning if you had coverage in place on the day of the crash, you have coverage for life for reasonable expenses as a result of that accident. You do not have to pay premiums ever again to maintain coverage. Health insurance on the other hand is based on the coverage when the claim is made – the coverage in place on the days you seek healthcare. If you lose your job, you must pay COBRA to keep coverage or buy health coverage on the marketplace. If you are severely injured due to a crash and cannot afford to keep up your monthly premium payments, you will no longer have coverage for accident-related expenses.

- If anyone covered by the policy loses qualified health coverage, they must notify their insurer within 30 days of the loss of coverage.

Resources Available

To help protect drivers and families, CPAN, Michigan’s consumer advocate for auto insurance policyholders, has prepared a handout to assist consumers in making these choices. It provides a comprehensive comparison of No-Fault Unlimited/Lifetime medical coverage versus what is covered under Medicare, Medicaid, and qualified health insurance. This flyer is a valuable educational tool that will help your patients with these insurances as their primary health coverage make informed auto insurance coverage decisions.

More consumer information about Michigan auto insurance, including explainer videos and a FAQ section, can be found at ShopYourPolicyMI.com. There are also special pages for seniors and Medicaid beneficiaries.

Additionally, an article from CPAN legal counsel Sinas-Dramis can be found here.